tax per mile rate

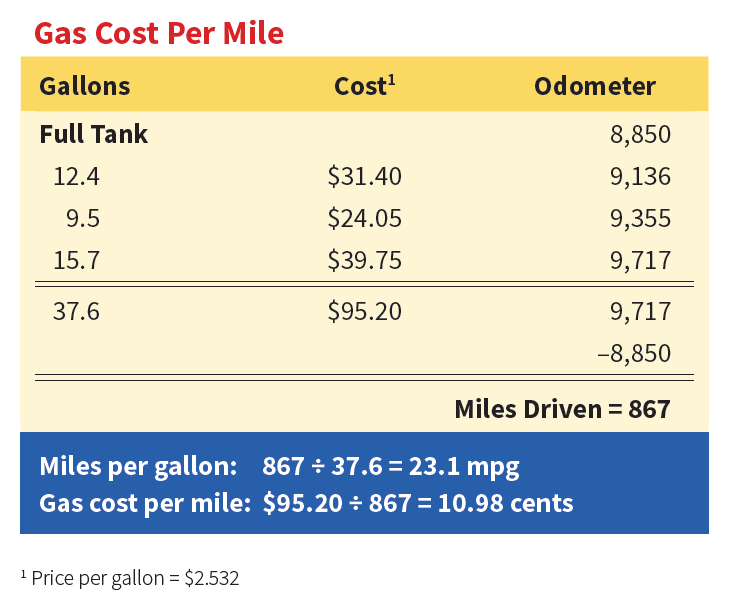

78 cents per kilometre for 202223 72 cents per kilometre for 202021 and 202122 68 cents per kilometre for 201819 and 201920 66. Flat Monthly Fees Rate Table form 9927-2020 Weight-Mile Tax Tables A and B.

What The Half Cent Drop In The Standard Mileage Rate Means For Drivers Stride Blog

15 rows The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the deductible costs of.

. What Mileage is Tax Deductible. Instead a portion of the rate is. Only payments specifically for carrying passengers.

A set rate the IRS allows for each mile driven by the taxpayer for business charitable medical or moving purposes. Your 2022 Tax Bracket To See Whats Been Adjusted. However this is just a national average which means your area may have higher or lower rates.

Ad Compare Your 2023 Tax Bracket vs. The 14 cents per mile rate for charitable. Users are expressing concerns about the cost of.

You cannot use the standard mileage rates if you claim vehicle depreciation under the Modified Accelerated Cost Recovery System MACRS. Rates per business mile Example Your employee travels 12000 business miles in their car - the approved amount for the year would. You may use this rate to reimburse an employee for business use of a personal vehicle and under certain.

585 cents per mile for business purposes 18 cents per mile for medical and moving purposes 14 cents per mile for charity purposes IRS Standard Mileage Rates from July. The actual rate per vehicle should be differentiated based on weight per. Rates Rates are reviewed regularly.

At the time of writing the national average flatbed truck rates are 314 per mile. Use HMRC s MAPs working sheet if you need help. 575 cents per mile for.

To set a fair. As well as the 575 cents for business miles. Request Additional IFTA Decals form 9744 Pay per decal pair on qualifying amounts.

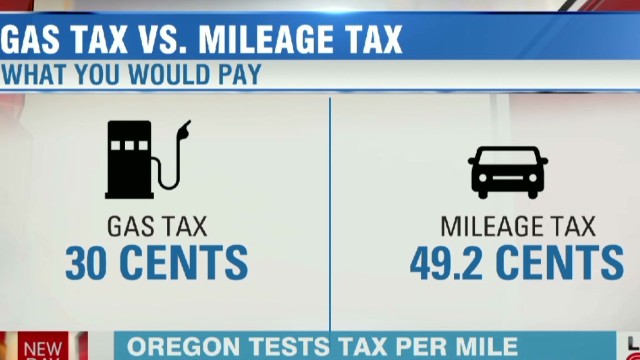

How much should I charge per mile. For the current tax year you can claim the standard mileage rate of 575 cents for every business mile driven. Currently there is talk on social media about the vehicle mileage tax program.

17 cents per mile driven for medical or moving purposes down three cents from the rate for 2019 and 14 cents per mile driven in service of charitable organizations. If a business chooses to pay employees an. As for Q1 Q2 of 2022 this rate is 585 cents per mile you drive while between July 1 and December 31 2022 the federal business mileage rate is 625 cents per mile the same as the.

Cents per mile 2020 rate. What is the vehicle mileage tax program. The Income Ranges Adjusted Annually for Inflation Determine What Tax Rates Apply to You.

Standard Mileage Rate. Ad Compare Your 2023 Tax Bracket vs. Your 2022 Tax Bracket To See Whats Been Adjusted.

5p per passenger per business mile for carrying fellow employees in a car or van on journeys which are also work journeys for them. A federal VMT tax rate must average 17 cents per mile to cover the highway funds expenditures. 45p per mile is the tax-free approved mileage allowance for the first 10000 miles in the financial year its 25p per mile thereafter.

Taxpayers always have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates. 585 cents per mile driven for business use up 25 cents from the rate for 2021 18 cents per mile driven for medical or moving purposes for qualified active-duty members of the. The business mileage rate for 2022 is 585 cents per mile.

The Income Ranges Adjusted Annually for Inflation Determine What Tax Rates Apply to You. Cents per mile Business. 56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of.

The standard mileage rate can. The standard mileage rates are. Beginning January 1 2020 the standard mileage rates for the use of a car van pickup or panel truck will be.

Irs Issues Standard Mileage Rates For 2022

Irs Increases Mileage Rate For Remainder Of 2022 Internal Revenue Service

The Irs Increased The Mileage Rate For The Rest Of 2022 Ketel Thorstenson Llp

Driving Down Taxes Auto Related Tax Deductions Turbotax Tax Tips Videos

By The Mile Tax On Driving Gains Steam As Way To Fund U S Roads Bloomberg

2019 Mileage Rate Increase Hm Taxes

Irs Mileage Reimbursement 2022 Everything You Need To Know About

The Standard Business Mileage Rate Is Increasing In 2022 Kpm

The Current Irs Mileage Rate See The Irs Mileage Rates For This Year

Mileage Vs Actual Expenses Which Method Is Best For Me

Tax Deductions For Rideshare Uber And Lyft Drivers And Food Couriers Get It Back

Could You Be Taxed Per Mile Cnn Video

Irs Mileage Rate Is 58 5 Cents Per Mile For 2022

Irs Mileage Rate Explained Triplog

2020 Mileage Rate Update Rate For Business Miles Decreases

Aaa S Your Driving Costs Aaa Exchange

Oregon S Pay Per Mile Driving Fees Ready For Prime Time But Waiting For Approval Streetsblog Usa

2020 Standard Mileage Rate Fort Myers Naples Markham Norton

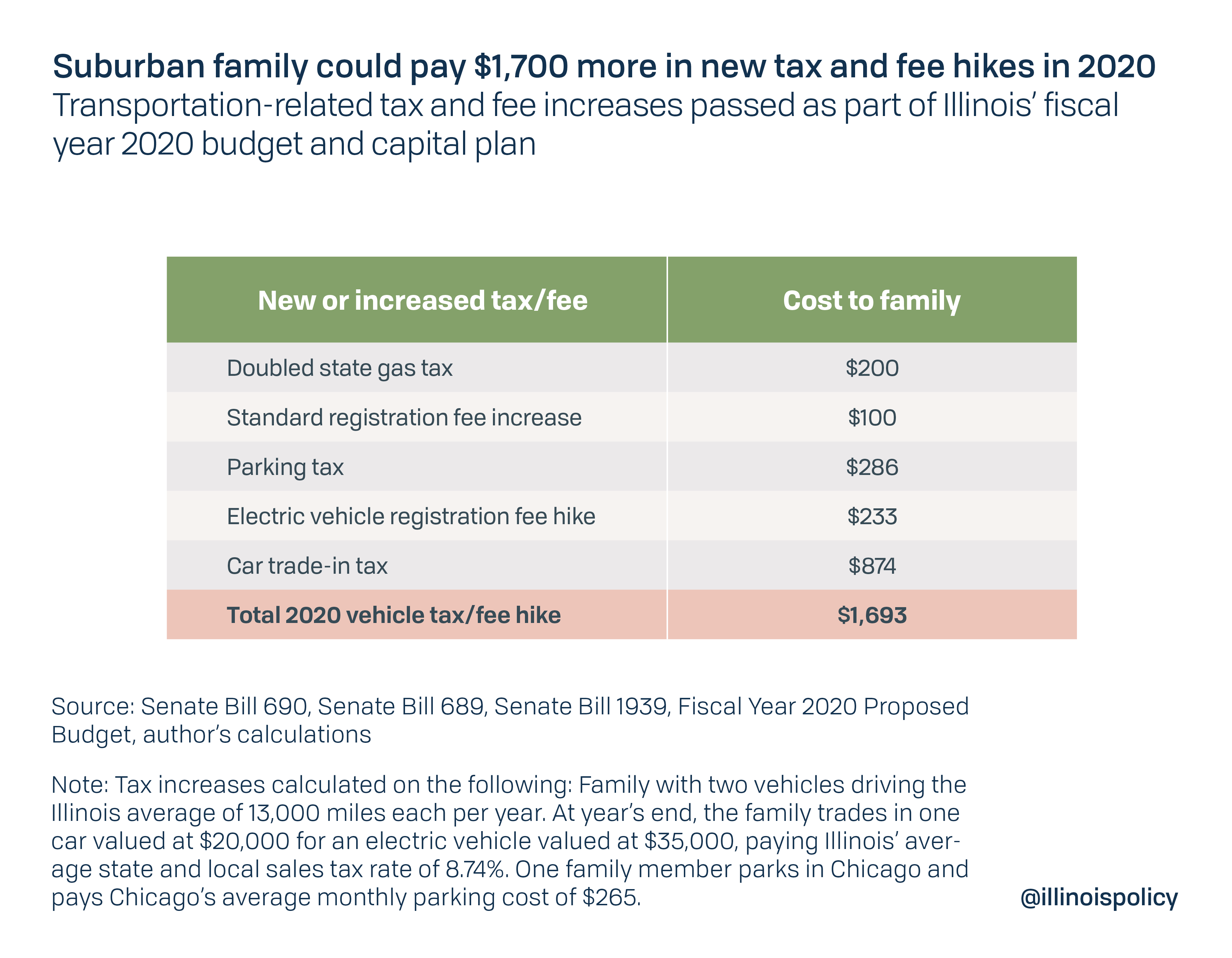

Suburban Families Could Pay 1 700 More In Vehicle Related Taxes Starting Jan 1